“History Doesn’t Repeat Itself, but It Often Rhymes” – Mark Twain

The Great Depression was a severe worldwide economic depression that took place mostly during the 1930s, beginning in the United States. It was the longest, deepest, and most widespread depression of the 20th century. The stock market crash of 1929 led to the Great Depression and was a prelude to World War II.

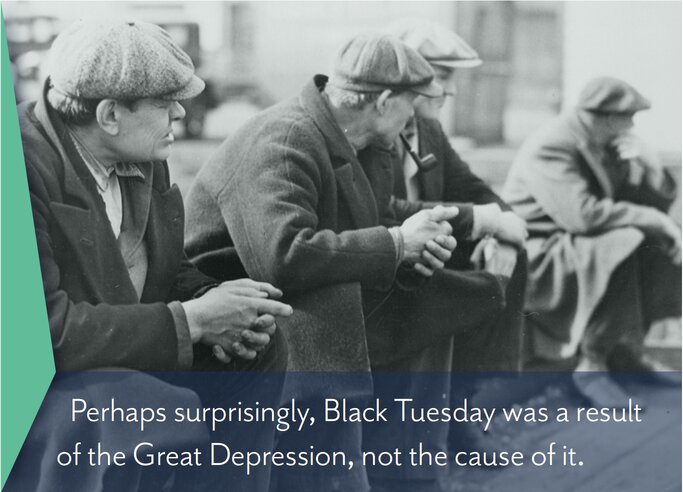

The Great Depression started in the United States after a major fall in stock prices that began around September 4, 1929, and became worldwide news with the stock market crash of October 29, 1929, (known as Black Tuesday). Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession.

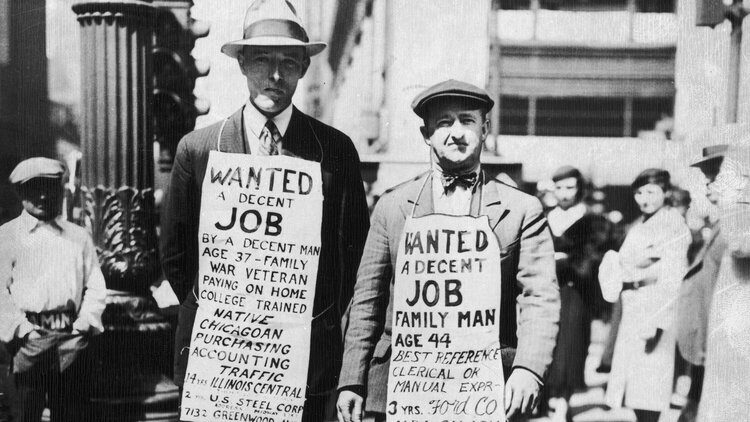

The Great Depression had devastating effects on both rich and poor countries. Personal income, tax revenue, profits, and prices dropped, while international trade fell by more than 50%. Unemployment in the U.S. rose to 23% and in some countries rose as high as 33%.

In his Great Courses Class, Capitalism vs. Socialism: Comparing Economic Systems, Edward F. Stuart Professor Emeritus of Economics at Northeastern Illinois University, shares some great insights on the cause and effect of the great depression:

The Paradox of Thrift

At the beginning of a recession or economic downturn, it’s wise for individuals and households to cut back on spending and build up some cash reserves to prepare for the potential bad times. Businesses might cut back on new equipment orders or cancel some expansion plans if they think there will be a decrease in demand for their products.

However, if the behavior is widespread, the macroeconomy will suffer. Total spending will fall, total incomes will fall, production will fall, and unemployment will rise. Keynes labeled this phenomenon the paradox of thrift: In periods of recession or depression, saving—or being thrifty—actually causes more economic hardship throughout the macroeconomy. This was especially true during the Great Depression.

Mass unemployment is a breeding ground for political instability and extremist political parties. Many historians blame the rise of Nazi Germany on the effects of the Great Depression.

Galbraith’s Five Causes of the Great Depression

In his book The Great Crash, 1929, John Kenneth Galbraith listed five principle causes of the Great Depression. For each cause, subsequent policies and institutions were developed to prevent, or at least reduce, the probability of another Great Depression

- The first cause was a tremendous inequality of income and wealth. An economy of extremely wealthy and extremely poor people is unstable in a capitalist economy. Those who are wealthy tend to become less aware, or fearful, of risk and tend to have a more unstable spending pattern. In contrast, poor people have a relatively stable spending pattern. As income becomes concentrated in the hands of the rich, it doesn’t have to be spent, causing a decrease in total spending. Household debt rises in low-income families, and any economic downturn—and loss of employment—causes numerous personal and business bankruptcies.

- The second cause was the shaky state of corporate structures. Corporations were largely unregulated in the 1920s and earlier and had little government supervision of their financial information or financial practices. Additionally, a new form of investment vehicle was created, called the investment trust, which was a security created by combining into one basket the shares of stock in many individual corporations. As long as enough people were buying shares of stock, the market kept going up, but as soon as investor sentiment changed and growing numbers of people tried to sell their stock, then there was the potential for a stock market panic—and crash.

- The third cause was the structure of the banking system. Some banks were sound; they made good loans and did not speculate in risky stocks. But banks lend to one another. When a shaky bank fails, it can’t repay the good bank, and the good bank can’t satisfy all of its depositors’ claims either. Prior to the mid-1930s, there was very little regulation and oversight of U.S. banking activities. Although the Federal Reserve Board had been created by Congress in 1913, it was run by bankers and political appointees who tended to adopt the viewpoint of commercial bankers.

- The fourth cause was concentrated outside of the United States. Although the United States had few exports at the time—and therefore the country was not dependent on sales of U.S. products to foreigners—it had lent large sums of money to European governments after World War I to help rebuild Europe. Then, the United States imposed very high duties on imports under the Smoot-Hawley Tariff Act of 1930. European imports to the United States fell, and European companies and banks began to fail. A bank collapse in one European country spread to other countries, and the Great Depression took hold in Europe before it hit the United States.

- The last major cause of the Great Depression was the profound state of ignorance about macroeconomics.

The Glass-Steagall Act

To improve the banking structure and provide more security for depositors, Congress passed the federal Banking Act of 1933, better known as the Glass-Steagall Act, which separated commercial and investment banking and created the Federal Deposit Insurance Corporation (FDIC).

Galbraith maintains that the creation of the FDIC did the most to restore stability and confidence to the American banking system. There have been no systemic bank runs in the United States since. American depositors know that their deposits—up to an insured limit—are safe.

The Glass-Steagall Act was repealed late in the Clinton administration in 1999, and some believe this repeal is responsible for the financial markets crisis of 2007 and 2008.

FDR’s New Deal

- The reform of American capitalism as a result of the Great Depression began with the first administration of Franklin D. Roosevelt in 1933 and the beginnings of the New Deal.

- The first major policy initiative of the Roosevelt administration was FDR’s March 1933 order to temporarily close all banks and decide which were healthy enough to reopen. After this, Roosevelt pressured the Federal Reserve to increase the nation’s money supply and to take the United States currency off the gold standard.

- To remedy the bad corporate structure leading up to the Great Depression, the New Deal created the Securities and Exchange Commission, a federal agency responsible for ensuring that publicly traded corporations produce accurate financial information and that stock markets operate in a fair and orderly manner. Its political structure, consisting of five presidentially appointed commissioners—with the party in power always holding a majority—all but ensures that many major decisions are narrow majorities in danger of being reversed next term.

- To get the economy moving again during the Great Depression, expansionary monetary policy was necessary but would not be sufficient. Fiscal policy, including direct government spending, was also necessary to revive the economy.

- FDR ordered public works projects at the hands of the Civilian Conservation Corps, which put young people to work in national parks and forests. The federal government also funded the Public Works Administration to reduce unemployment through the construction of highways and public buildings.

The New Deal also created the Social Security Act of 1935 to counter the poverty of the American elderly, as well as widows and orphans. The Social Security Act also contained provisions for federally funded unemployment insurance.

We have been here before, rising mass unemployment, a global pandemic, collective amnesia, high mental health crisis, and a host of unintended consequences of the capitalist system. Are we on the verge of another global recession circa 1929 or 2008?

Comments are closed.