Built to Sell illuminates the qualities that business buyers look for in a company, by telling a story. Through the lead character, the advertising agency owner of Alex Stapleton teaches the fundamental lessons he learns to apply to any business and reading about. The book is about how to create a business that can thrive without you. Once your business can run without you, you’ll have a valuable—sellable—asset.

The Plot

This is the story of an imaginary business owner named Alex Stapleton who wants to sell his business (in this case an advertising agency). The business is successful, and Alex has gained a loyal following of customers, but he has a problem. Since he has the most experience in his field, he does most of the selling for his company, and, not surprisingly, Alex’s customers all want him to personally oversee their projects.

Stretched thin and running from one fire to the next, Alex reaches a plateau and finds it impossible to get to the next level with his business. When he decides to sell, he meets with his old friend and successful entrepreneur Ted Gordon. The story unfolds as Ted teaches Alex how to turn his business into a sellable company.

There are approximately twenty-three million businesses in the United States, and yet only a few hundred thousand are able to be sold each year. That means for every small business owner who creates a business that someone will buy, there are about a hundred businesses that do not sell. This book provides a framework and action plan for ensuring that you are among that desired 1 percent.

Ted Gordon’s List of Advice to Alex Stapleton

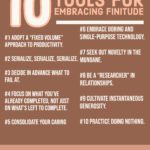

TED’S TIP # 1

Don’t generalize; specialize. If you focus on doing one thing well and hire specialists in that area, the quality of your work will improve and you will stand out among your competitors.

TED’S TIP # 2

Relying too heavily on one client is risky and will turn off potential buyers. Make sure that no one client makes up more than 15 percent of your revenue.

TED’S TIP # 3

Owning a process makes it easier to pitch and puts you in control. Be clear about what you’re selling, and potential customers will be more likely to buy your product.

TED’S TIP # 4

Don’t become synonymous with your company. If buyers aren’t confident that your business can run without you in charge, they won’t make their best offer.

TED’S TIP # 5

Avoid the cash suck. Once you’ve standardized your service, charge upfront or use progress billing to create a positive cash flow cycle.

TED’S TIP # 6

Don’t be afraid to say no to projects. Prove that you’re serious about specialization by turning down work that falls outside your area of expertise. The more people you say no to, the more referrals you’ll get to people who need your product or service.

TED’S TIP # 7

Take some time to figure out how many pipeline prospects will likely lead to sales. This number will become essential when you go to sell because it allows the buyer to estimate the size of the market opportunity.”

TED’S TIP # 8

Two sales reps are always better than one. Often competitive types, sales reps will try to outdo each other. And having two on staff will prove to a buyer that you have a scalable sales model, not just one good sales rep.

TED’S TIP # 9

Hire people who are good at selling products, not services. These people will be better able to figure out how your product can meet a client’s needs rather than agreeing to customize your offering to fit what the client wants.

TED’S TIP # 10

Ignore your profit-and-loss statement in the year you make the switch to a standardized offering even if it means you and your employees will have to forgo a bonus that year. As long as your cash flow remains consistent and strong, you’ll be back in the black in no time.

TED’S TIP # 11

You need at least two years of financial statements reflecting your use of the standardized offering model before you sell your company.

TED’S TIP # 12

Build a management team and offer them a long-term incentive plan that rewards their personal performance and loyalty.

TED’S TIP # 13

Find an adviser for whom you will be neither their largest nor their smallest client. Make sure they know your industry.

TED’S TIP # 14

Avoid an adviser who offers to broker a discussion with a single client. You want to ensure there is competition for your business and avoid being used as a pawn for your adviser to curry favor with his or her best client.

TED’S TIP # 15

Think big. Write a three-year business plan that paints a picture of what is possible for your business. Remember, the company that acquires you will have more resources for you to accelerate your growth.

TED’S TIP # 16

If you want to be a sellable, product-oriented business, you need to use the language of one. Change words like “clients” to “customers” and “firm” to “business.” Rid your Web site and customer-facing communications of any references that reveal you used to be a generic service business.

TED’S TIP # 17

Don’t issue stock options to retain key employees after an acquisition. Instead, use a simple stay bonus that offers the members of your management team a cash reward if you sell your company. Pay the reward in two or more installments only to those who stay so that you ensure your key staff stays on through the transition.

A teaser is a one- or two-page description of your business, which announces that your company is for sale and paints the picture of the opportunity your business offers a potential buyer.

Strategic vs Financial Buyers

Strategic buyers will typically pay more because you’re worth more to them than you would be to a financial buyer. A strategic buyer will model how you would perform as a business if they owned you and applied all of their resources to your business. A financial buyer is simply looking for a return on their investment and wouldn’t bring much more than their chequebook to a deal. With few synergies to exploit, financial buyers will typically offer you a lower price to ensure they get a good return on their money.

A nonbinding letter of intent. It’s not the same thing as a binding offer. They can walk away from their offer at any time for any reason.

Client vs Customer

Service firms refer to their customers as clients and product businesses refer to them as customers. You’ve worked hard to transform the Stapleton Agency from a service business into a product business with a standard scalable and repeatable process. Using words like ‘client’ subtly communicates to a potential buyer that you still think of yourself as a service business.

IMPLEMENTATION GUIDE: How to Create a Business That Can Thrive Without You

STEP 1: ISOLATE A PRODUCT OR SERVICE WITH THE POTENTIAL TO SCALE.

The first step in building a company that can thrive without you is to find a service or product that has the potential to scale. Scalable things meet three criteria:

(1) They are “teachable” to employees

(2) they are “valuable” to your customers, which allows you to avoid commoditization;

(3) they are “repeatable,” meaning customers need to return again and again to buy (e.g., think razor blades, not razors).

Once you’ve isolated what is teachable, what your customers value, and what they need most often, document your process for delivering this type of product or service

STEP 2 : CREATE A POSITIVE CASH FLOW CYCLE

To create a positive cash flow cycle, charge your customer in full or in part for your product or service before you pay the costs of whatever it is you provide.

Charging upfront for your product or service will be possible if you have documented and differentiated your unique offering properly (step 1). Depending on your service or product, you may not be able to charge the entire amount in advance, but try to get at least some portion of your money before delivery.

STEP 3 : HIRE A SALES TEAM

Once you have created and packaged your offering and started to charge up front, you need to remove yourself from selling it. If you have others delivering the product or service but you’re still the rainmaker, you will not be able to sell your business without a long and risky earn-out.

STEP 4: STOP SELLING EVERYTHING ELSE

Once you’ve assembled a great sales team, stop taking on projects that fall outside of the standard offering you identified in step 1. It’s tempting to accept these sales because they bolster your revenue and cash flow. If you’re charging upfront for your service or product and your salespeople are selling it, then you shouldn’t have to worry about cash flow. That leaves added revenue as the reason to accept projects that fall outside of your process.

STEP 5 : LAUNCH A LONG-TERM INCENTIVE PLAN FOR MANAGERS

If you’d like to have a business you could sell, you need to prove to a buyer that you have a management team who can run the business after you’re gone. What’s more, you need to show that the management team is locked into staying with your company after acquisition.

STEP 6: FIND A BROKER

The next step in the process is to find representation. If your company has less than $2 million in sales, a business broker will best serve you. If it has more than $2 million in sales, a boutique mergers and acquisitions firm is probably your best bet. Look for a firm with experience in your industry, as it will already know many of the potential buyers for your business. To find an M&A firm or business broker, ask for recommendations from other entrepreneurs you know who have sold their companies.

STEP 7: TELL YOUR MANAGEMENT TEAM

Once your broker has found a prospective buyer, he or she will set up management presentations for you and your team. At this point, you will need to confide to your key managers that you are considering selling your business.

An earn-out is used by an acquirer to minimize his or her risk in buying your company. This means that you take most of the risk, and the buyer gets most of the reward.

STEP 8: CONVERT OFFER(S) TO A BINDING DEAL

Once you have completed your management presentations, you will, you hope, get some offers in the form of a nonbinding letter of intent (LOI). A letter of intent is not a firm offer. Unless it includes a breakup fee (rare for smaller companies), the buyer has every right to walk. In fact, deals often fall through in the due diligence period ,so don’t be surprised if it happens to you.

All the Best in your quest to get Better. Don’t Settle: Live with Passion.

Comments are closed.